The Butterfly Effect: How Your Life Matters

Andy Andrews

4.5 on Amazon

3 HN comments

The Price of Tomorrow: Why Deflation Is the Key to an Abundant Future

Jeff Booth, Brian Troxell, et al.

4.5 on Amazon

3 HN comments

Pioneering Portfolio Management: An Unconventional Approach to Institutional Investment, Fully Revised and Updated

David F. Swensen

4.5 on Amazon

3 HN comments

Scaling Up: How a Few Companies Make It...and Why the Rest Don't (Rockefeller Habits 2.0)

Verne Harnish

4.6 on Amazon

3 HN comments

Way of the Wolf: Straight Line Selling: Master the Art of Persuasion, Influence, and Success

Jordan Belfort and Simon & Schuster Audio

4.7 on Amazon

3 HN comments

Trading in the Zone: Master the Market with Confidence, Discipline, and a Winning Attitude

Mark Douglas, Kaleo Griffith, et al.

4.7 on Amazon

3 HN comments

Technical Communication

Mike Markel and Stuart A. Selber

4.1 on Amazon

2 HN comments

Unlimited Power

Anthony Robbins and Simon & Schuster Audio

4.6 on Amazon

2 HN comments

Dying of Money: Lessons of the Great German and American Inflations

Jens O. Parsson

4.6 on Amazon

2 HN comments

Policy Paradox: The Art of Political Decision Making

Deborah Stone

4.5 on Amazon

2 HN comments

Simply Said: Communicating Better at Work and Beyond

Jay Sullivan

4.5 on Amazon

2 HN comments

Setting the Table: The Transforming Power of Hospitality in Business

Danny Meyer

4.6 on Amazon

2 HN comments

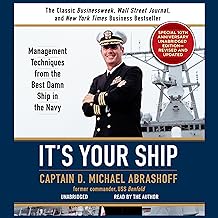

It's Your Ship: Management Techniques from the Best Damn Ship in the Navy

D. Michael Abrashoff and Hachette Audio

4.7 on Amazon

2 HN comments

The World Turned Upside Down: America, China, and the Struggle for Global Leadership

Clyde Prestowitz

4.6 on Amazon

2 HN comments

Value Proposition Design: How to Create Products and Services Customers Want (The Strategyzer Series)

Alexander Osterwalder , Yves Pigneur , et al.

4.6 on Amazon

2 HN comments

breckinlogginsonMay 12, 2021

module0000onDec 28, 2018

I haven't read any books about algorithmic trading(but I've read a ton about trading in general...favorite is Mark Douglas's 'Trading in the Zone'). Most of my introduction to algorithmic trading came from a trading platform(Multicharts.NET). I wasn't a .NET programmer specifically, but they include the source code for all indicators/signals that ship with the product. This made it really easy to tinker with automated trading signals, and I don't think I would have ever attempted it without that exposure.

Also, you didn't ask for this piece of advice...but: be very cautious of tips from any blog or news outlet. The people producing those are under tremendous pressure to produce "something", even when there isn't any insight to be had for a day/week/event/etc. They will produce something anyway, relevance be damned. If you needed some help/ideas, you would be better served joining a live trading group. Many of these are free, and they give you a chance to listen(and speak) to other traders, all trading at the same time, usually with the same instruments. I learned some things from GPI Trading Group(http://www.gpitradinggroup.com/) that saved me a lot of time and headache. They are focused on the ZB(bond futures, not equities), but back at that time so was I. I got a lot of feedback from their members about my indicators and automated signals I was working on, and much of it was invaluable.

pelleronApr 20, 2016

Things to note:

This is going to be hard work. It will take time (years for most). Take notes on everything you think and do (keep a trading journal).

You will loose money at first (consider it your "tuition").

Don't put too much weight on the publication date of a resource. Certainly, some specifics of market implementation have changed over the years, but as a whole, human nature (fear and greed) is the same now as it was when the first humans decided to build financial markets.

I know you didn't mention books as a preferred learning source, but, IMO they contain the most condensed stores of knowledge by the most reputable people (read: retired and/or independent) on this subject. Here's my list of recommendations:

High Probability Trading by Marcel Link

How Technical Analysis Works by Bruce Kamich

How to Buy by Justin and Robert Mamis (out of print; worth every penny)

When to Sell by Justin and Robert Mamis

Trading in the Zone by Mark Douglas (don't underestimate the importance of getting your psyche under control!)

Japanese Candlestick Charting Techniques by Steve Nison

Market Wizards by Jack Schwager (these are well worth reading)

And of course, the timeless classic, Reminiscences of a Stock Operator by Edwin Lefevre

Good luck!