Guns, Germs, and Steel: The Fates of Human Societies

Jared Diamond Ph.D.

4.5 on Amazon

239 HN comments

Flash Boys: A Wall Street Revolt

Michael Lewis

4.6 on Amazon

89 HN comments

The Making of the Atomic Bomb: 25th Anniversary Edition

Richard Rhodes, Holter Graham, et al.

4.6 on Amazon

84 HN comments

The Code Book: The Science of Secrecy from Ancient Egypt to Quantum Cryptography

Simon Singh

4.7 on Amazon

82 HN comments

The Signal and the Noise: Why So Many Predictions Fail - but Some Don't

Nate Silver, Mike Chamberlain, et al.

4.4 on Amazon

53 HN comments

Homo Deus: A Brief History of Tomorrow

Yuval Noah Harari

4.6 on Amazon

40 HN comments

Collapse: How Societies Choose to Fail or Succeed: Revised Edition

Jared Diamond

4.5 on Amazon

38 HN comments

Barbarians at the Gate: The Fall of RJR Nabisco

Bryan Burrough and John Helyar

4.7 on Amazon

38 HN comments

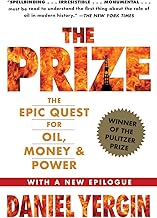

The Prize: The Epic Quest for Oil, Money & Power

Daniel Yergin

4.7 on Amazon

36 HN comments

The Rise and Fall of the Third Reich: A History of Nazi Germany

William L. Shirer, Grover Gardner, et al.

4.7 on Amazon

27 HN comments

Einstein: His Life and Universe

Walter Isaacson, Edward Herrmann, et al.

4.6 on Amazon

26 HN comments

Nothing to Envy: Ordinary Lives in North Korea

Barbara Demick

4.7 on Amazon

20 HN comments

Common Sense: The Origin and Design of Government

Thomas Paine and Coventry House Publishing

4.8 on Amazon

19 HN comments

Bowling Alone: Revised and Updated: The Collapse and Revival of American Community

Robert D. Putnam

4.3 on Amazon

19 HN comments

The Road Less Traveled: The Secret Battle to End the Great War, 1916-1917

Philip Zelikow

4.7 on Amazon

19 HN comments

huy-nguyenonMay 7, 2020

toshonAug 2, 2019

https://queue.acm.org/detail.cfm?id=2536492

lclarkmichalekonJan 22, 2019

Barbarians at the Gate is a popular book that goes into the details while telling the story of a large LBO.

mattmonFeb 23, 2011

annajohnsononSep 13, 2010

wp381640onJune 19, 2018

It's also a breezy read - I tore through it in a couple of sittings.

aedrononOct 15, 2018

Barbarians at the Gate is a classic business book about such a case (the takeover of RJR Nabisco).

josuonOct 21, 2015

http://www.amazon.com/Barbarians-Gate-The-Fall-Nabisco-ebook...

uirionJan 10, 2018

sailfastonFeb 20, 2020

Spoiler / Hot Take: if you're overloading the company up with debt (even cheap, short-term stuff) and taking out cash based on "revenue projections" or "realized synergies" it's probably not gonna work out so hot when the loan comes due.

ecqonNov 18, 2009

1) iCon Steve Jobs: The Greatest Second Act in the History of Business

2) The Google Story

3) The Perfect Store: Inside eBay

4) Paypal Wars

5) Barbarians at the Gate (not tech-related but one of the best business books of all time)

bostikonJune 10, 2020

Loaning money to high-risk companies? Bundling a whole bunch of said loans into securities? High returns despite the risk of a significant fraction of defaults? Sounds like the world has been here before.

If this was a B-flick, it might well be called the return (or revenge) of the junk bond monster.

awillenonFeb 8, 2019

Barbarians at the Gate is a good example of this - it required authors who were able to dig deep into _what_ happened. There's obviously some info on why things happened there as well, but the primary purpose of the book is to inform the reader of what occurred, which is a good use of the journalistic skill set.

mason55onMar 19, 2021

Because the hours worked translate so directly into increased chances of winning the deal, it really does become a prisoners dilemma amongst all the firms. If they could all stick to 40 hour weeks then no one would have an advantage based on hours worked, but all it takes it one firm to defect and it's game over, welcome back to 100 hour weeks.

sailfastonJuly 28, 2016

harperleeonJan 20, 2015

EDIT: This article: https://news.ycombinator.com/item?id=8526319

mattmonApr 13, 2013

dharmononNov 29, 2017

- The Destiny of the Republic, by Candice Millard. The shooting of Garfield is the framing of this book. It covers a time period I knew such little about (~1880s), so I learned so much reading it. Just a crazy, interesting story in many ways.

- The Forever War, by Filkins. Sort of a series of vignettes by a reporter covering Afghanistan, then Iraq during the war. I still don't know what to think / feel about it, but I've recommended the book several times.

- Barbarians at the Gate, by Burroughs, Helyar. A classic that I put off reading for years because I thought it would be a slog (it's sort of long), but I finished in a week. I love business history / case study books, and this is one of the most famous, for good reason. If you like this also check out Predator's Ball, which I read this year. It's about Milken and the junk bond era.

wagerlabsonJune 25, 2010

My wife is a self-employed travel agent catering to the Russian market (I'm Russian/Cuban). I she would love to go into property management, specially if the property is ours.

I'm reading about LBOs in "Barbarians at the gate" and I think it's a bit like that. You need to figure out the potential rental income of a property and convince the bankers that it's enough to service the mortgage debt. All the while putting as little of your own money in as possible.

NomentatusonNov 15, 2017

Among the best though: Barbarians at the Gate, Enron: The Smartest Guys in the Room, most books concerning the history of medicine and any Trump biography published after he leaves office, no doubt. Any Jobs biography. The story of NeXT - his European head committed fraud that brought the company down.

Years ago I read an excellent biography of John D. MacArthur, the Insurance giant that would suit you well. Famous now for the "Genius Grants" given out by the MacArthur Fellows Program. John D. Rockefeller (who would argue his own virtues, of course.) Wolf of Wall Street.

On my list to read:

Images of organization Paperback – Jan 1997

by Gareth Morgan (Author)

https://www.amazon.ca/Images-organization-Gareth-Morgan/dp/0...

The Organization Man

by William H. Whyte

http://a.co/2kRfJHA

The above 2 books said to be consistent with The Gervais Principle:

https://www.ribbonfarm.com/2009/10/07/the-gervais-principle-...

Plus

The Prince of War: Billy Graham's Crusade for a Wholly Christian Empire

by Cecil Bothwell

http://a.co/17NKkDg

and

MOTHER TERESA: The Untold Story

by Aroup Chatterjee

http://a.co/hqumhdA

Plus a small pile of (contemporary) books about slavery, and slavery as a business, most in the public domain, now.

One problem you might encounter is that sociopaths often do very well in business, but are not always interesting in a story-sense because their self-concern is so predictable. Mere lack of empathy isn't a motive, so wrapping a detailed story around that is pretty hard.

larrysonSep 7, 2013

Agree. There was a story in a book regarding Henry Kravis of KKR (I think it was Barbarians at the Gate) where he fired the President of a hotel chain he had acquired when he merely asked him his opinion of the new signage (or logo don't remember exactly but it was something like that).

topkai22onMay 7, 2020

This is often a fantastically expensive enterprise that requires that the new owners raise tons of money. The new owners do this by structuring a deal where the company will take out a ton of debt (basically its entire market capitalization of the company, plus a premium) to purchase the outstanding shares. This is known as a leveraged buyout (LBO).

So if a public company has $100M in outstanding shares and zero debt before they go private, by going private the private company will now have $100M of debt (rough numbers, illustrative but not necessarily realistic). That's why going private often results in dramatic sell offs and cost cutting- the new company needs to get the debt load down, and fast.

Definitely read Barbarians at the Gates, it's a great book and explains a lot about private equity from a dramatic case in the 80s.

cturneronSep 25, 2012

If you're in the US and come up with a product there are lots of options for accessing new markets fast. If you're in Japan then you have a much larger audience, captive, most of it in close proximity. Australia has low population. It's heavily concentrated in the cities, but they're a significant distance apart.

I became aware of this when I read "Barbarians at the Gate". Early on, it describes the rise of RJR Reynolds. I found it amazing that you could just get on your horse and ride on to the next city with your capital and ideas and make acquisitions and expand.

Australia could chase edge by becoming a low-tax or low-red-tape capital. But never does :)

rtpgonJan 7, 2020

As to why it’s not illegal... there’s both the realpolitik “who are friends with congresspeople” as well as the wonky “how do you make it illegal? It’s just combining a lot of elements of capitalism”

The way you make it illegal, of course, is preventing stuff like directors being able to get paid big bonuses for buyouts (basically bribes to accept LBOs), by properly classifying such movements as stealing assets from the company

sramsayonOct 9, 2019

fullsharkonApr 16, 2017

e15ctr0nonAug 26, 2016

A good book to read on one of the most notorious examples of an LBO is Barbarians at the Gate [1][2] which dealt with the takeover of RJR Nabisco, a large American food and tobacco company.

For lighter fare, re-watch the 1990 movie Pretty Woman [3][4] but this time ignore the fluffy romance and focus on Richard Gere's character, Edward Lewis, as he goes about negotiating the LBO of a shipbuilding company. Edward Lewis was modeled on a real-life LBO guy, Reginald Lewis, who bought Beatrice International Foods from Beatrice Companies in 1987 in an LBO worth $985 million [5].

[0] https://en.wikipedia.org/wiki/Leveraged_buy_out

[1] https://en.wikipedia.org/wiki/Barbarians_at_the_Gate:_The_Fa...

[2] http://amzn.com/0061655554

[3] https://en.wikipedia.org/wiki/Pretty_Woman

[4] http://www.imdb.com/title/tt0100405/

[5] https://en.wikipedia.org/wiki/Reginald_Lewis

mindcrimeonDec 25, 2014

Neuromancer - William Gibson

Predictable Revenue - Aaron Ross, Marylou Tyler

The Fountainhead - Ayn Rand

The Ultimate Question 2.0 - Fred Reichheld

The Singularity is Near - Ray Kurzweil

Moonshot! - John Sculley

Zero To One - Peter Thiel

Republic - Plato

Meditations - Marcus Aurelius

Nineteen Eighty-Four - George Orwell

Fahrenheit 451 - Ray Bradbury

The Mysterious Island - Jules Verne

Discipline of Market Leaders - Michael Treacy, Fred Wiersema

False Memory - Dean Koontz

NOS4A2- Joe Hill

Revival - Stephen King

Barbarians At The Gate - John Helyar and Bryan Burrough

Into Thin Air - John Krakauer

How To Measure Anything - Douglas Hubbard

and any collection of the works of H.P. Lovecraft.

dmixonOct 30, 2008

santiagogoonMar 23, 2018

But generally the high amount of leverage implies aggressive cost cutting, which negatively impacts the employees and in some cases R&D, which in turn means risking the future sustainability of the company for short term profits.

If you're interested in the topic, "Barbarians at the Gate" is a great book to understand the in and outs of LBO's. The writing style also makes it fun to read.

arbugeonJan 22, 2017

This simplistic analysis however ignores that before the buyout the company might have been a prosperous self-sustaining entity fully capitalized by common stock with little debt. That common stock, made into a small percentage of the capital structure by the buyout, is often wiped out too in the event of bankruptcy - indeed it is usually at the bottom of the totem pole in that capital structure. So although they may no longer be majority owners, bankruptcy is typically an unhappy event for long-time stockholders of the company such as founders, employees holding company stock in their 401ks, etc.

Perversely this is the kind of company PE outfits typically go after - in their worldview it is a waste of leveraging potential not to apply debt to such a company. I recommend reading "Barbarians at the Gate" if you are interested in this topic.

TychoonFeb 4, 2013

mattmonJuly 25, 2010

It's an eye-opening book about just how removed upper management of a public company can be. Although I don't have much anecdotal experience to back it up, I think people who start their own companies and grow them are much more likely to be honorable than employees who worked their way up to become CEO. Being upper management of a large corporation is generally a golden ticket. Even if you do a horrible job, you will probably still receive millions in pay and stock options. In fact, because the organization is so large, it will probably take a couple years for people to figure out if you are doing poorly. By that time, you already have your money.

Because of the incentives, I would think that people trying to get into these types of positions would be much more ruthless than people who generated their wealth through their own means.

Like I said, I don't have much experience with this but it is how I imagine things are.

bradleyjgonDec 11, 2012

A few pieces of advice: under no circumstances do you want to get caught in the weeds of technical analysis, similarly stay away from the gold bugs, and finally learning is good, but don't jump in unless you are prepared to lose your shirt.

mindcrimeonAug 8, 2015

Steve Jobs - Walter Isaacson

Artificial Life - Steven Levy

On Writing - Stephen King

Machine Learning for Hackers - Drew Conway and John Myles White

How Doctors Think - Jerome Goopman

Cholesterol Clarity: What The HDL Is Wrong With My Numbers? - Jimmy Moore & Eric C. Westman

Barbarians at the Gate: The Fall of RJR Nabisco - Bryan Burrough & John Helyar

TomOfTTBonAug 12, 2011

In the book Barbarians at the Gate one of the co-creators of "Pen Windows" tells the story of that failure and what he told his fellow co-creator. Here's a quote from the book...

[Begin Quote]

"Greg, Look. This wasn't a thing about making money. This was all about 'Block that Kick.' We were on the special team. We were preventing GO from running away with the market. That was our job.

Look, your background is in applications, you have to ship the application. My job is in systems. Systems, for much longer on, has been completely 'Don't let anybody else steal DOS from us.' That's all we're doing. We weren't trying to sell software, we were trying to prevent other people from selling software.

From my view, Pen Windows was a winner. We shut down GO. They spent $75 million pumping up this market, we spent $4 million shooting them down. They're toast!"

[End Quote]

Sorry for the long winded post but I wanted to point out how old this strategy is. .Net wasn't a product to make money it was a product to block Java. By making it the default Windows development environment they were able to do so without flushing money down the toilet (as was done in the example above)

So, as Miguel De Icaza says in the piece, Microsoft really doesn't love .Net the way Xamarin does. They still want people developing for Windows alone. Their developers just happened to create a great tool while management was paying lipservice to cross platform development.

dave_sullivanonMar 24, 2016

Here's a question: all these big old companies are in the market for startups that they can buy to fix their business. Why not buy the big old company instead, build the product there, and keep more of the value generated? I think we'll see much more of this over the next few years: PE going after old guard tech cos like yahoo (or amd) OR going after old guard non-tech and automating everything.

stvswnonMay 3, 2019